News & Media

All the Latest News, media and Buzz on Shago

Shago Payments Officially Launches

December 16, 2020 - One year after its initial entrance into the Nigerian market, a pioneering fintech startup, Shago Payments, officially launches.

Shago maintains a culture of holding an annual reorientation session for

workers to remind them of the organization's vision, mission, and goals.

During this year's session, the Shago brand standards were given by

Linda Ahaneku, the Chief Operating Officer, who stressed the

importance of staff

members seeing themselves as brand ambassadors. According to her,

this is important since the brand begins with them, and their

behavior in and outside the workplace determines how people perceive

the brand.

Joy Igbinoba, Human Resource Lead, also spoke on the company

culture. She mentioned that as the company grows, its culture also

grows. She also read to the team an updated culture adopted by the

company.

Diana Ekpat, Brand & Communication Lead, took the team through the

company's updated communication strategy and the events that the

company would be sponsoring in the coming quarter to create more

visibility.

Rounding up the session, the MD/CEO expressed his

profound appreciation to the team, stating how pleased he was to

share this vision with the team, as well as the progress made so

far. He encouraged everyone to remain united and focused, adding

that each person's efforts had been noticed and would not go

unrewarded.

"Afterward, the team members were allowed to air any

problems or challenges they may have faced. In this light, several

team members expressed their satisfaction with the management's

intentions for the staff. In addition, they expressed their

willingness to put in their best effort, work with the company, and

build a brand that is worthy of emulation.

The reorientation thereafter ended with all staff members excited

and energised to put in their best to achieve set targets."

Introducing Sportsbet account top-up on the Shago App.

You can now fund your Sportsbet account through the Shago platform.

for various betting companies; bet9ja, nairabet, 1xbet, betway,

betking, supabet, merrybet, bangbet, betlion,

cloudbet, livescorebet, betland, naijabet, and lots more. To further

entice her users, Shago is offering this

product and service for free.

Bringing good tidings to your screen.

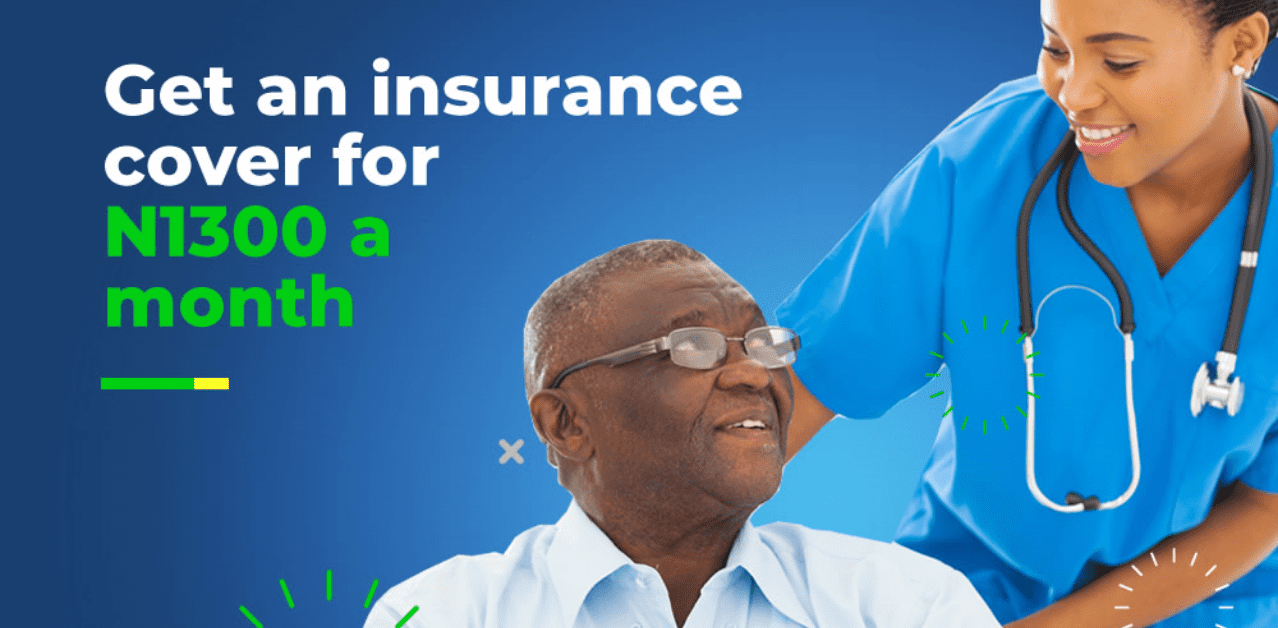

As they say, "your health is your wealth", and good health cannot be

taken for granted.

Still on the journey to create value for our users and the

underserved market, we are glad to present our health

insurance product - Shago Health.

Shago health powered by Wellahealth is a health protection plan that

is structured to provide affordable access to

high-quality health care anywhere in Nigeria, leveraging a vast

network of community pharmacies. With just N1,300,

you gain access to free medical plan plus; Malaria test + treatment,

Diabetes screening, Telemedicine, Covid-19

helpline, heart disease screening, health loans, and so much more.

As an innovative company, we embrace growth as it comes.

That’s why we spend time strategising on how to continuously improve

the quality of our service to our customers and

increase our brand loyalty.

On this note, we introduce our mobile application, designed with

class and comfort with an improved user experience

and journey. Something is cooking in our software laboratory and

would come your way soon.

Guess what?

Shago and Chisco is on the move with a thrilling offer. All Chisco

ticketing service for local and international bus trips is now

available on the Shago platform.

If you going on a road trip for business of vacation, with simple

and quick steps on Shago, your journey is secured.

December 16, 2020 - One year after its initial entrance into the

Nigerian

market, a pioneering fintech startup, Shago Payments, officially

launches.

Founded by Sabastine Enechi, Shago Payments offers integrated financial

tech

solutions that are tailored majorly for Nigeria’s underserved and

unbanked population.

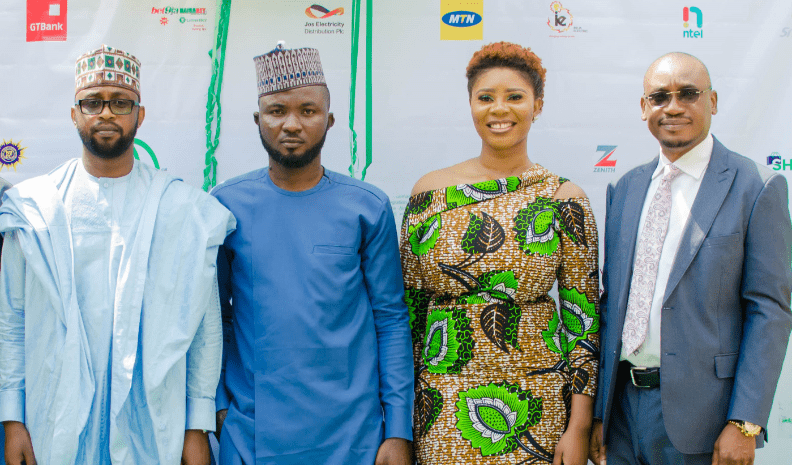

Speaking at the launch, which was attended by many dignitaries,

Enechi

attributed the success of Shago to the collaborative efforts and

support

from

corporate partners.

He added that innovation is key and is equally an essential driver

of its

business module, which integrates different financial products and

services.

Also speaking at the launch, the Group Head, Digital Banking at

Providus

Bank

Plc., Mr Frank Atat, buttressed the importance of collaboration.

According

to

him, collaboration is very essential for product longevity and

sustainability,

especially when drafting a long-term plan.

“It is important to recognise that the need to collaborate will

always bring

opportunities for partners.

“The collaborative support helps save cost among other benefits

including

the

ability to scale faster in the market,” Frank said.

He went ahead to dispel the notion that banks are threatened by

platforms

offering digital solutions.

Rather, he believes that platforms like Shago are mostly ready to

collaborate, a

move that allows for co-existence in the financial industry.

Another speaker, Mr Kayode Ariyo, Director, Global Accelerex,

commended the

startup for its resilience, considering Shago launched during one of

the

most

critical moments in human history.

He said, “Surviving the heated moment of the pandemic as a startup

is a

major

milestone for the company that is worth emulating.”

He further acknowledged how innovation has made life easier, with

complex

analogue machines being replaced with portable digital alternatives.

Founded on January 1, 2020, the platform doubles as an e-commerce

platform, enabling merchants to enlist their products and services for

visibility.

Despite the constraint faced during launch due to the COVID-19 pandemic,

Shago Payments registered clients grew

by 3000 in the initial 12 months,

channelling over N7 billion in 2020 alone.

According to Shago founder Mr Sabastine Enechi, the platform focuses

on adding 10,000 more clients with at least 200 e-businesses in the

short term.

However, the platform is currently connected directly to over 25

billers who carry out transactions through Shago’s App and WEB

channels around the clock while earning an instant commission on

every successful transaction carried out on the platform.

Unlike any other platform, the ease of doing business with Shago is

seamless, and this is attributed to the platform’s stability with

99.9% uptime and 24/7 customer and operation support.

More so, Shago has, in its short period of existence, earned a

couple of corporate partnerships with the likes of PTSPs, Banks,

Digital services, and Telcos, further making transacting on the

platform a lot more convenient.

In the future, Shago plans to work with CBN, SANEF, and EfiNA to be

a part of the bigger picture – achieving financial inclusion in

Nigeria.

In recent times, the global financial space has become more stiffened

and

overwhelmingly competitive, thanks to the emergence of alternative

digital solutions.

Financial technology (fintech) firms, for example,

have repeatedly shown to be a powerful force that cannot be

suppressed in the quest to reengineer the global financial system.

Leveraging on cutting-edge technologies, fintech firms are rapidly

changing the scope of modern banking and consumer behaviour by

offering innovative yet simple solutions.

Simple solutions like bankless transaction, mobile transaction, and

lower barriers when accessing funds, among others, have now become

remedies to several challenges that have plagued traditional banking

until recently.

However, fintech companies have built a new structure around these

solutions, making them even more accessible and straightforward for

the use of the general public, who are progressively adapting to the

new banking reality.

Financial technology firms have also played an active role in

filling the gap between financial access and financial inclusion,

which appears to be a common concern among many nations, including

Nigeria.

Specifically, only about 44% of Nigerian Adults, put at 99.6 million

as of September 27, 2020 (according to world population review),

have their bank accounts linked to a unique Bank Verification Number

(BVN).

This further suggests that around 56% of Nigerian adults, and

possibly more based on lower age demographics, are still

unbanked.

In comparison, Enhancing Financial Innovation and Access (EFInA)

puts the figure of unbanked Nigerians at 60 million (60%) in 2018,

suggesting that only 4 million adults or thereabout gained access to

financial services or products within the last two years.

Although this broadly indicates that there is still a lot of ground

to be covered in terms of financial inclusiveness, the notable

impact of fintech solutions cannot be undermined as they have driven

the majority of the growth captured above.

Interestingly, many corporate organisations and industry experts

still believe that the fintech industry is merely scratching the

surface of financial inclusion in Nigeria.

Currently, the Nigeria fintech landscape is made up of close to 250

fintech companies; three key stakeholders, including banks, telcos,

and the government; and four enablers and funding partners (i.e.

Universities and research institutions, investors, incubators,

technology, and consumers) who have heavily invested over $250

million since 2014.

Relative to the global market, Nigeria has barely made half of the

1% contribution to the over US$100B that has been invested in

fintech globally; hence, it is arguably correct that the fintech in

the country is still taking baby steps.

However, the Nigeria fintech industry is continually striving to

make a difference, especially in complementing the gaps left by the

traditional banking structure.

Also, despite being an emerging market, Nigeria fintech space is

expected to take a major leap from its current status; recent

research by Frost and Sullivan forecasts a revenue peak of about

US$543.3 million in 2022 from around US$200 million recorded in

2018.

This projection is fueled by a lot of factors; first, by some

attractive fundamentals in the country, such as a youthful and

tech-savvy population. Secondly, there has been an enormous

attraction of both foreign and local investors who are willing to

stake massively in the country’s growing tech ecosystem.

Other factors that tend to accelerate the growth of fintech firms

also include increasing smartphone penetration, currently put at 143

million as of December 2020, coupled with a focused regulatory drive

capable of boosting financial inclusion and cashless payment.

As of now, fintech solutions in Nigeria is broadly categorised into

four major integrated entities – payment & transfers; savings &

investment; insurance; and lending.

Other categories, such as remittance and cryptocurrency, are also

starting to gain a lot of attention and traction.

As for Shago Payments, the fintech startup majorly focuses on

payment, transfers, savings, investment, and e-commerce, five

factors around which the company’s operation is built.

As a fintech firm or related platform offering financial products and

services such as earlier discussed, it is essential to understand the

market wherein it operates clearly.

Also, a fintech firm must look beyond the fundamental growth-driven

factors in terms of demographic advantage and a wild gap between

financial access and inclusiveness,

both of which are sufficient to drive significant growth for a

company if well utilised.

On the other hand, the firm must be willing to explore other crucial

market opportunities such as product innovation and strategic

partnership with finance-driven corporate organisations, including

banks.

Furthermore, the firm must also be willing to build a structure, not

just offline, but rather a mix of physical and digital (online),

while ensuring that there are next to zero barriers to its products

and services.

Technology-wise, a fintech firm must - by all means possible - avoid

staying obsolete in terms of technology adoption, since this is one

of the most significant advantages enjoyed in the field.

There are currently four key emerging technologies mostly adopted by

the majority of the fintech players. They include Application

Program Interface (API), Artificial Intelligence (AI), Distributed

Ledger Technology, and Biometrics.

According to EFInA, fintech is segmented based on the technologies

mentioned above, and the most important of them all globally is

AI.

Notably, the Nigeria fintech space is dominated by market segment

API, followed by market segment AI, DLT, and Biometrics. In

comparison, the most relevant segments for financial inclusion

globally are in market segment digital banking and technological

segment distributed ledgers, APIs, and Biometric.

Overall, it is important that a firm is up to date in its adoption

of any of these forms of technologies to stay afloat in the rapidly

emerging market.

Lastly, some major key trends have been observed in the Nigeria

fintech space, and although some are favorable, others may pose as

major limitations in terms of efficiency. Specifically, there has

been an increase in loan and savings players, implying that the

market will get more stiffened and competitive sooner rather than

later.

There has also been an increase in fintech-banks partnership, a move

that many industry experts believe to be healthy for co-existence in

the financial industry generally.

Telco providers are also not left out in the struggle to stay

relevant as critical players are now offering competitive solutions

such as mobile money.

Furthermore, there has been a continual adoption of new and

innovative solutions, which has caused older ones to quickly become

obsolete.

In the same vein, the talent gap is increasing due to the emergence

of new fintech solutions.

The reason for this revolves around the fact that specialists are

quick to migrate to more developed markets, hence, leaving the

former vacancy for either no one to fill or perhaps at the hands of

fairly-skilled engineers.

In conclusion, fintech thrives where there is a wide gap between

financial access and inclusion. While regulations can limit their

scope of operation, they are capable of providing complex and

long-term solutions.

To flourish as a startup in the Nigerian financial sector, it takes more

than a strategic plan and, or positioning; nevertheless, Shago Payment,

unlike the vast majority, is challenging the status quo.

Arguably true, the Nigerian financial technology

(fintech) industry is rapidly evolvinng, capitalizing on fundamental

issues associated with the legacy banking system.

Take for instance, the inaccessibility of banking services,

particularly in rural areas, poor user experience or perhaps

constant delay in processing transactions either at the counter or

behind a long queue.

Guess what? These are just little among several other challenges

facing the unbanked and underserved population when they sort to

carry out transactions on a daily basis.

Although the adoption of fintech solutions in Nigeria are long

overdue and mostly required for everyday financial transactions,

considering the level of technology advancement around the globe,

they are often perceived as a disruptive innovation in the regional

financial space.

Interestingly, the inception of fintech solutions have further

exposed the redundant nature of the traditional banking system,

allowing for the rapid growth experienced in the fintech

space.

Also, the ripple effect of the booming fintech market on the Nigeria

economy, although enormous, is mostly underspoken - a narrative that

is about to change with the entrant of Shago Payments amongst

others.

Currently, the Nigeria fintech ecosystem is made up of over 200

standalone companies alongside a couple of fintech solutions offered

by banks and mobile network operators as an inclusive part of their

product portfolio.

As a result of its enabling environment, Nigeria’s bustling fintech

space attracted over $600 million in funding between 2014 and 2019.

In 2019 alone, Nigeria attracted 25% (aprox $122 million) of the

total $491.6 million raised by tech startups across the African

region.

While Nigeria was not the biggest gainer in the said year, it was

second only to Kenya which attracted an additional 5% to cap a total

investment of $149 million

In the same vein, there has been quite an enormous investment pumped

into the Nigeria fintech scene even in recent time, and it will only

get better with time.

As of now, industry experts are of the opinion that fintech firms

are merely scratching the surface of financial inclusion in Nigeria,

further suggesting that there are yet a lot of untapped

opportunities.

At a time when there are an influx of players in the Nigeria fintech

space, it is essential for corporate firms to define their

proposition, while putting their best foot forward.

The forgoing part of this article will highlight the major market

proposition put to use by Shago Payments and how it intends to

thrive

in the highly saturated fintech space alongside its frontline

competitors.

Shago Payments was initially registered in July 2018, however, became

operational on the 1st of January 2020, after which it publicly launched

on the 16th of December 2020.

The fintech startup set out into the Nigeria market at a time many would

deem impossible as a result of the unprecedented COVID-19 pandemic

that

struck the world unexpectedly.

As if that was all it takes to scale at the initial stage, Shago

Payments persisted amidst all odds, most of which were built on the

back of the nationwide lockdown measure imposed by the Nigeria

federal government.

During the first six (6) and twelve (12) months of operation, the

company was able to record approximately N1.7 billion and N7.9

billion in transaction volume, respectively. Currently, Shago

Payments now completes an average monthly transaction volume of

about

1.7 billion with plans to double that number by the end of the

year.

In addition, in its first year, the fintech company was able to

establish a nationwide agent network with over 3000 registered

members. In the most recent development, Shago Payments now has over

4000 registered agents in the field, bringing the monthly

transaction volume closer to N2 billion.

In comparison, not many financial firms could claim of these numbers

at such an early stage of operation, especially given the

restrictions imposed by the current epidemic.

Shago has been able to achieve this in bearly 15 months of entering

the market.

Among other things, partnership is quite a big deal for Shago

Payment who have since launch, established corporate partnerships

with at least 10 banks.

More so, the platform has over 25 billers as well as over 15

corporate entities registered as B2B resellers for Shago Payments

offerings.

Shago Payments will provide personalized services.

In

order to address key issues such as financial inclusion in Nigeria,

it is critical to develop tailored solutions capable of addressing

the user's everyday needs. Shago Payments is a financial technology

solution provider that prioritizes its customers and is strategic

about its products and services.

The integrated platform offers unique services such as C’Gate

cardless POS, and prepaid health plans, both of which are rare to

come by on other platforms that offer similar solutions.

Furthermore, Shago Payments provides a diverse range of 13 products

and services, which is almost double the typical offering on most

platforms.

The need for the aforementioned stems from an in-depth study and

understanding of the market within which it operate; one that is

made up of diverse people with different needs.

To meet the needs of its users, Shago Payments services are suited

for three different groups of people– the banked, underserved, and

unbanked – while addressing their unique needs.

Ultimately, offering financial solutions isn't enough;

rather, delivering unique services that caters for different

categories of users makes our work as a targeted service provider

much simpler.

Although access to financial services is undoubtedly a major barrier to

financial inclusion, it may surprise you to hear that trust likewise

plays a significant role in financial service adoption. The lack of

trust in a fintech business ultimately impact financial inclusion.

Sadly, getting people to put their trust in fintech entities has

been a challenge over the past decade. Notably, most people, tend to

believe in what they see over what they cannot.

In context, for the

majority, trusting the legacy ‘brick and mortar’ banks is way easier

than trusting the bulk of players in the fintech industry who barely

have a single physical office.

According to a report by McKinsey, customer adoption of fintech is

largely driven by access and convenience with trust playing a

critical role.

Despite consumer dissatisfaction with legacy banking

services and the intervention of fintech products to solve these

pain points, the transition to fintech is hardly a stroll in the

park for many people, according to the report.

Access, convenience, value, affordability, and other factors

(including trust) all play a key role in fintech adoption, according

to the research.

Among these factors, access & convenience were the highest

contributors, collectively accounting for roughly 57% of the reasons

for fintech adoption.

While value and price contributed 29% and 13%

respectively, trust among other unspecified factors contributes the

least to the quota.

On the back of these stats, most fintech companies have shifted

their focus to delivering on other fronts where trust isn't as

important. For instance, fintech companies are very big on

delivering outstanding user experience, affordability (i.e, little

or no transaction charges), and most importantly, easy-to-access

services, the majority of which are lacking by most legacy banks.

How to resolve distrust in the fintech business

Although there are no easy ways to win consumers' trust, a fintech

startup, for instance, may tackle the distrust issue regarding its

own establishment by continually evolving and experimenting with new

ideas.

To do this, a fintech company, especially startups, can employ some

of the strategies utilised by large, well-established fintech firms.

Some of these strategies include the establishment of transparency,

localization, and partnership.

Another way to resolve distrust as a fintech company is by

enlightening users about your security protocols, as well as

embracing data protection policies.

Talking about Data protection,

Fintech consumers place a great value on data security and are

generally confident in it's safety only when it is safeguarded by a

competent regulating agency.

Lastly, a fintech can resolve the issue of trust by paying attention

to customers’ feedback. It is common knowledge that customers like

to be heard, or perhaps feels like they are heard. This also goes

without saying that a brand that listens is a brand that can be

trusted.

The Role of Agent Networking in Gaining Consumers’ Trust

Besides all that has been said, there is one more important aspect

of the fintech business that is capable of building trust among

customers.

Namely agent networking, this particular approach, like

the traditional banking framework, also leverages physical

structure.

Notably, agent networking has proven to be beneficial in the

provision of physical touchpoints for digital financial services,

allowing users to engage with human agents.

While the bulk of fintechs' business models is future-proof,

transiting from the "brick and mortar" banking system is a process

that must be done gradually, especially in situations where trust is

de facto.

To this end, Integrating an agent networking system might be of

great help, and at the very least, restore trust among fintech

customers who are still leaning toward the traditional banking

system. Although this may not be the case in urban settings, it

works rather well in rural regions.

Finally, like with financial inclusion, trust is critical to fintech

adoption, and the sooner fintech players discover a sustainable way

to build trust in consumers, the faster they can scale.

Every organization is defined not only by “what they do,” or “how they

do it” but most importantly “why.”

An organization that can provide an

ideal answer to the “why” question may have just established the purpose

of its establishment.

Although the debate over organizational purpose is an age-long one,

businesses are now, more than ever, paying closer attention to their

role in running a corporate business.

Likewise, there is growing pressure on organizations to go beyond

and above, albeit with a defined purpose, which in the long run is

to contribute positively to society.

While the need for a well-defined purpose in a business is

indisputable, employees are also caught between finding a purposeful

life and working long hours, which can be challenging to achieve

given the amount of time spent at work.

As a result, employees tend

to concentrate their sense of purpose around the jobs they spend

most of their time doing.

Moreover, there is already an unpleasant narrative about the

corporate sector, as some perceive it as contemporary slavery,

particularly in toxic workplaces or perhaps owing to the long hours

spent at work.

By carving out a business purpose, which has recently become a

growing trend in the corporate sector, employees tend to have a

different view about employee-employer relationships, as well as

workplace culture in general.

How purpose influences an organization’s culture

An organization’s purpose statement can influence the overall

culture both positively and negatively. A well-defined

organization’s purpose can boost team morale and foster healthy

collaboration.

On the other hand, if poorly defined, it can limit individual

output, or, influence employees' attitudes toward work negatively,

and at worst, increase an organization's attrition rate.

Also, when employees can resonate with a purpose statement, they

feel a sense of belongingness, and unconsciously exhibit a healthy

attitude towards work which ultimately contributes to better

workplace culture.

Why should a company care about purpose ?

Defining an organizational purpose is very critical, owing to the

considerable impact on business, human resources, and customers.

And while it shouldn’t be merely written as a fancy phrase (i.e.

vague),

an organizational purpose should also represent the company's

essence and much more, be aspirational, inspirational, and

motivational.

Beyond its internal affairs, a company must also care about defining

its purpose, because of the ripple effect on its product’s

end-users. A report by McKinsey revealed that customers tend to

boycott the products of companies whose values they view as contrary

to their own.

Although it can be hard to satisfy the desires of every customer at

times, defining a purpose that contributes positively to society, in

the long run, makes it simpler to meet every customer, at a

midpoint.

That said, an organization must endeavor to stay committed to its

purpose, as it is critical for scalability.

How to come up with a company’s purpose

Usually, carving out a well thought out and tailored purpose may be

challenging, as there are a lot of factors to be considered. More

so, a company’s purpose is bigger than the entity itself; the

product, services, technology, team members, and even the leadership

team.

According to industry analysts, an organization's purpose is a deep

reflection of its corporate entity, or what the company stands for.

Depending on the circumstances, a company's purpose may show itself

through changes in strategy, governance, or even public image.

To this end, a purpose should be capable of driving decisions and

actions, both internally and externally. How? You may ask.

Some practical steps employed by top organizations when defining

organizational purpose include;

i. Defining company’s essence,

ii. Incorporating the company’s core value,

iii. Use of simple and comprehensive language,

iv. Incorporating emotional element,

v. ensuring that fit into the company’s culture, and lastly vi. It

must

fit into the company’s culture.

Ultimately, the role of purpose in an organization is crucial, and

it must be established such that it resonates with all the

business's vital entities.

At the end of 2021, there was a wave of incorporated B2B companies into

Nigeria’s economic and commercial space.

In Africa as a whole, it was recorded that B2B start-ups attracted a

cumulative $164. 5 million in equity and debt financing.

Essentially, B2Bs was considered a notable trend in the space of fintech

in 2021.

What is B2B?

B2B is short for Business to Business. As the name implies, it is a

business model in which a company involved creates products and

services for other companies and businesses. It can be regarded as a

supportive company that helps other companies to boost their affairs

through its services. In addition, B2B companies provide meaningful

help to their customers’ businesses to significantly increase their

level of productivity and performance.

It should be noted that B2B companies are not created to exclusively

sell products and services. They may just exist as a platform for

other businesses to showcase their products and services. B2Bs are

important to every business because businesses need to purchase

products and services from other businesses to launch, operate and

grow.

What is the difference between a B2C and a B2B?

B2C is an acronym for Business to Consumer as opposed to B2B which

is Business to Business. B2C companies render services directly to

consumers who might be regular individuals or members of a

household. For B2B companies, however, services are rendered to

persons and organisations which can be from multiple departments in

an organisation. In addition, for B2C companies, purchases are done

in smaller sizes and quantities, whereas in B2B companies, purchases

are done in larger sizes and quantities.

Who are the customers/clients of B2B companies?

The customers of B2B companies vary from other companies to

retailers as well. It all depends on the kind of products and

services that the initial B2B Company is rendering. For instance, a

retailer that deals in goods of marketable quality might require the

services of a B2B company for a credit card processor, or a POS

machine, to enable the retailer to run its business seamlessly.

SHAGO as a B2B Company

SHAGO is an innovative solution provider with expertise in providing

value-added services and on-demand service deliveries for other

businesses. This description translates the nature of SHAGO into a

B2B company that sells its services to businesses.

SHAGO’s vision of creating value for all has come to fruition

through retailing digital and financial services to an agent network

and other businesses via an API connection. This means that SHAGO is

a B2C company as much as it is a B2B company.

Why should other B2Bs connect to SHAGO?

SHAGO provides varieties of products and services to other B2Bs on a

commission model, to drive value in their various affairs. These

services include:

(i) SHAGO BILLS: B2Bs can make use of SHAGO BILLS API to offer bill

payment services to users on their platforms, thereby reducing the

time spent on product development, and improving their overall

performance standards.

(ii) E-SHAGO: SHAGO E-commerce offers B2Bs an online marketplace to

showcase their goods and products. This helps B2Bs to advertise

their products to be able to reach customers without constraints and

ultimately boost their profits.

(iii) SHAGO-On-demand: SHAGO offers B2Bs a platform that enables

their customers to pay directly for their on-demand services and

also facilitates transactions with ease.

Written by Nkem Adigwe